POPULAR (BPOP)·Q4 2025 Earnings Summary

Popular Inc Crushes Q4 as NIM Expansion Drives 32% Earnings Growth

January 27, 2026 · by Fintool AI Agent

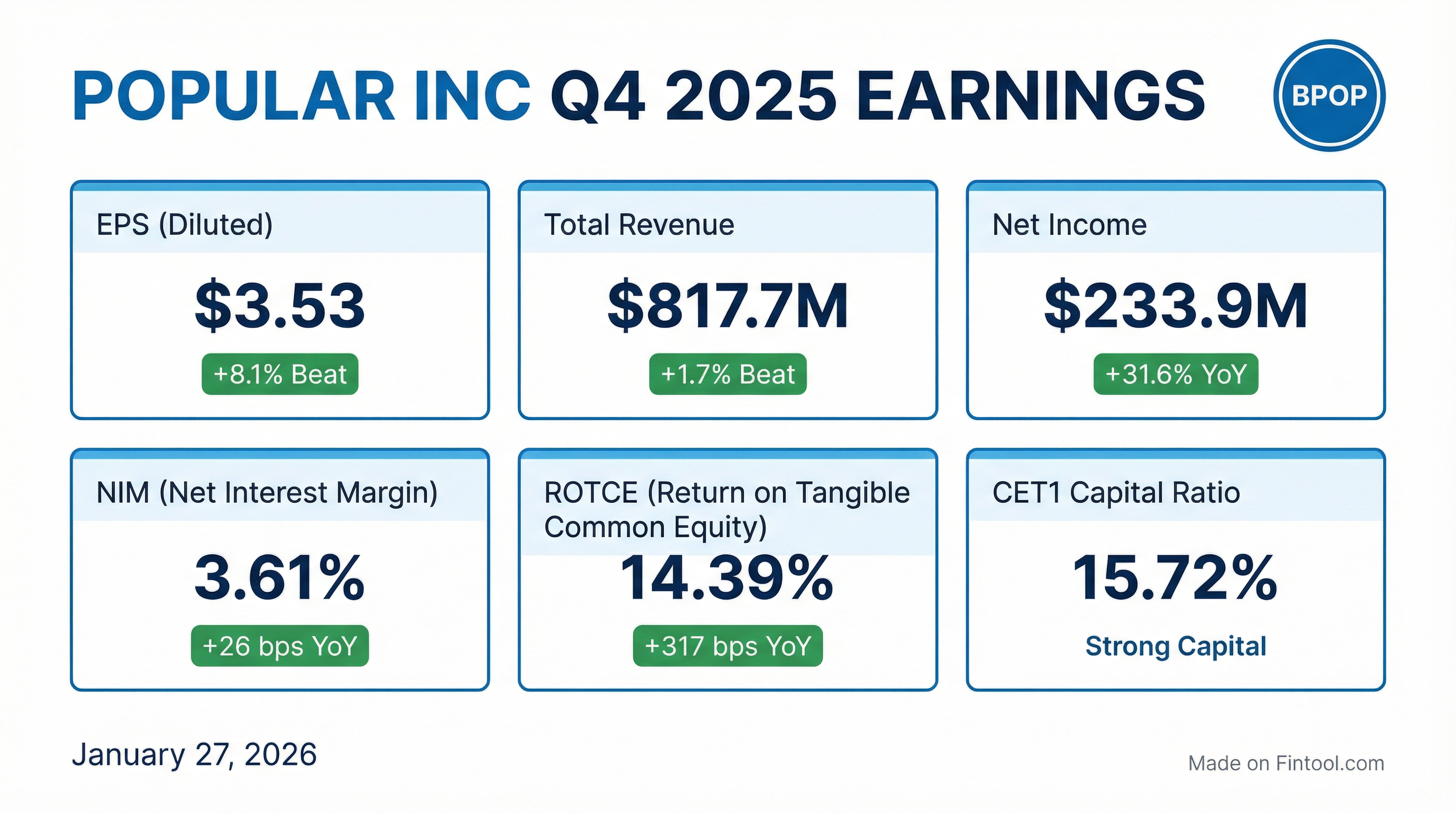

Popular, Inc. (BPOP) delivered a blowout Q4 2025, beating EPS estimates by 8.1% as net interest margin expansion and disciplined expense management drove a 32% year-over-year increase in net income. The Puerto Rico-based bank reported EPS of $3.53, up 41% from Q4 2024, while ROTCE surged to 14.39%—exceeding management's 14% target for the first time.

Did Popular Beat Earnings?

Yes—decisively. Popular beat on both EPS and revenue:

The EPS beat was driven by:

- Net interest income up $11M QoQ to $657.6M on lower deposit costs

- $15.3M partial reversal of FDIC special assessment reserve

- Strong credit quality with NCO ratio declining to 0.51%

Excluding the FDIC reserve reversal, adjusted net income was $224.2M and adjusted EPS was approximately $3.39—still a solid beat.

What Changed From Last Quarter?

The story at Popular continues to be NIM expansion and improving profitability:

Key drivers of the improvement:

-

Puerto Rico public deposit repricing — Costs fell 22 bps to 2.97% as market-linked deposits reset lower following Fed rate cuts

-

Loan growth — Loans held-in-portfolio grew $640M (+1.7% QoQ) to $39.3B, led by commercial and construction lending

-

Expense discipline — Operating expenses declined $22M QoQ to $473M, aided by the FDIC reserve reversal and absence of Q3's $13M goodwill impairment

What Did Management Guide?

Popular provided constructive 2026 guidance reflecting confidence in continued NIM expansion:

The guidance implies FY 2026 NII of approximately $2.67B-$2.72B (vs. $2.54B in 2025) and continued profitability improvement.

How Is Credit Quality Holding Up?

Credit metrics remained stable to improving despite elevated NPLs from two large commercial exposures in Q3:

Key observations:

- NPLs declined $4M to $498M; the Q3 spike from two unrelated $188M commercial exposures appears contained

- NCOs decreased $8M to $49.6M, including $5.3M in recoveries from sales of previously charged-off auto and credit card loans

- Consumer credit remains manageable — Auto NCOs at 4.72% reserve coverage, credit cards at 7.25%

Management emphasized that the two large Q3 commercial loan classifications were "attributable to borrower specific circumstances" and "not indicative of the broader credit quality within the portfolio."

What Did the CEO Say?

CEO Javier D. Ferrer struck an optimistic tone:

"In 2025, we delivered results that reflect the strength of our franchise and the continuous stability of the Puerto Rico economy. Our annual net income of $833 million increased by $219 million, or 36% compared to 2024."

On profitability targets:

"We demonstrated significant progress in our efforts to improve our sustainable returns towards our 14% objective. We are very pleased to have exceeded a 14% ROTCE for the quarter and a 13% ROTCE for the full year."

On strategic execution:

"We are executing on our strategic framework to be the number one bank for our customers by strengthening relationships and providing exceptional service and products... We're also focused on delivering solutions faster and improving productivity while reducing costs."

On technology investments:

"We deployed a new consumer credit origination platform in Puerto Rico and the Virgin Islands. This platform provides a fully digital origination process for personal loans and credit cards... we have originated approximately 36 million since launch in the third quarter."

Capital Return and Valuation

Popular continues to aggressively return capital while maintaining fortress-level capital ratios:

Full year 2025 capital actions:

- Repurchased 4.66M shares for $501.5M at an average price of $107.61/share

- $281M remaining under the $500M buyback authorization announced in Q3 2025

- Increased quarterly dividend from $0.70 to $0.75/share (+7%)

At the current price of ~$123, BPOP trades at 1.5x tangible book value and approximately 10x 2026E earnings.

Segment Performance

Banco Popular de Puerto Rico (BPPR)

The core Puerto Rico franchise delivered solid results:

Popular U.S. (Mainland Operations)

The U.S. segment showed strong improvement:

The U.S. segment's NIM expansion (+17 bps) was driven by the full quarter impact of U.S. Treasury Note purchases and online savings deposit repricing.

Full Year 2025 Highlights

Popular delivered record profitability in 2025:

Q&A Highlights: What Analysts Asked

On NIM and NII guidance: Management confirmed they expect margin to continue expanding throughout 2026. The 5-7% NII guide is driven by continued reinvestment of lower-yielding securities, loan originations, and lower costs on Puerto Rico public deposits and online deposits at Popular Bank.

On loan growth guidance (3-4% vs 6% in 2025): CFO Jorge García explained the moderation reflects: (1) expected softening in consumer demand, particularly auto loans, and (2) a deliberate focus on pricing for relationships and profitable growth in the U.S.

On auto market outlook: Management expects Puerto Rico auto sales to decline ~5% from 111,000 units in 2025 to roughly 105,000 in 2026—still a strong year historically (pre-COVID years above 100,000 were considered excellent). They anticipate potential pricing pressure as competition intensifies for smaller volumes.

On capital structure optimization: CFO highlighted that Popular has only ~5 bps of additional Tier 1 capital versus peers at 50-100 bps, calling this "another lever" and "an opportunity we're evaluating." This could allow them to lower CET1 while maintaining total regulatory capital.

On M&A appetite: CEO Ferrer outlined six criteria for any potential acquisition: (1) compelling enough to reallocate transformation resources, (2) strengthen deposit franchise with low-cost deposits, (3) commercial-led and provide CRE diversification, (4) geographically consistent, (5) right-sized for U.S. business (no MOEs), and (6) cultural fit. He emphasized transformation remains the priority.

Puerto Rico Economic Tailwinds

CEO Ferrer highlighted significant reshoring momentum driving capital investment in Puerto Rico:

"During last year, multiple companies announced new investments or expansions in Puerto Rico, of all sizes, representing about $2.2 billion in total capital investment and the creation of more than 4,600 jobs."

Notable investments announced in 2025:

- Eli Lilly: $1.2B to modernize and expand pharma manufacturing in Carolina (~1,100-1,200 jobs)

- Amgen: $650M to expand biopharm operations in Juncos (~760 jobs)

- 17 total entities announced new investments through reshoring initiatives

Management indicated they expect more large announcements in 2026 based on pipeline visibility.

Additional economic positives cited:

- Record airport passenger traffic of 13.6 million in 2025 (+3% YoY)

- Hotel demand up 11% YoY in Q4, driving 4% revenue growth

- U.S. military stepping up presence in the Caribbean—management sees this as "net positive" with contracts flowing to local businesses

Key Risks to Monitor

-

Puerto Rico public deposit concentration — P.R. public deposits represent 29% of total deposits; outflows and repricing can create volatility

-

Commercial credit normalization — While the two large Q3 NPL additions appear idiosyncratic, classified loans in C&I remain elevated at 6.25% of the portfolio

-

Rate sensitivity — Continued Fed cuts could pressure loan yields faster than deposit costs reprice, though P.R. public deposits provide a natural hedge

-

PREPA bankruptcy uncertainty — CEO Ferrer flagged the unresolved Puerto Rico Electric Power Authority bankruptcy as "something that's lurking" and a potential "tax on economic growth." Resolution expected in 2026 but outcome uncertain.

-

Affordability pressures — Management cited affordability as a key concern that could impact home creation and consumer segments if inflation escalates

The Bottom Line

Popular delivered an excellent Q4 that caps a transformational 2025. The bank achieved its 14% ROTCE target a quarter ahead of schedule, grew tangible book value by 21%, and demonstrated that its NIM expansion story has legs. With P.R. public deposit costs still repricing lower and loan growth accelerating, the setup for 2026 looks favorable.

The stock has run from ~$78 to ~$123 over the past year (+58%), but at 1.5x TBV and 10x earnings with a 2.4% dividend yield, it doesn't screen as expensive for a bank delivering mid-teens ROTCEs with fortress capital ratios.